The onset of the COVID-19 pandemic in early 2020 is the greatest challenge faced by Bali’s hotel owners, operators, and investors since the first hotel catering for foreign tourists was built in central Denpasar in 1926. Actions taken by the Indonesian Government and other nations to slow the transmission of the virus have severely affected the hotel industry’s profitability and its medium-term outlook.

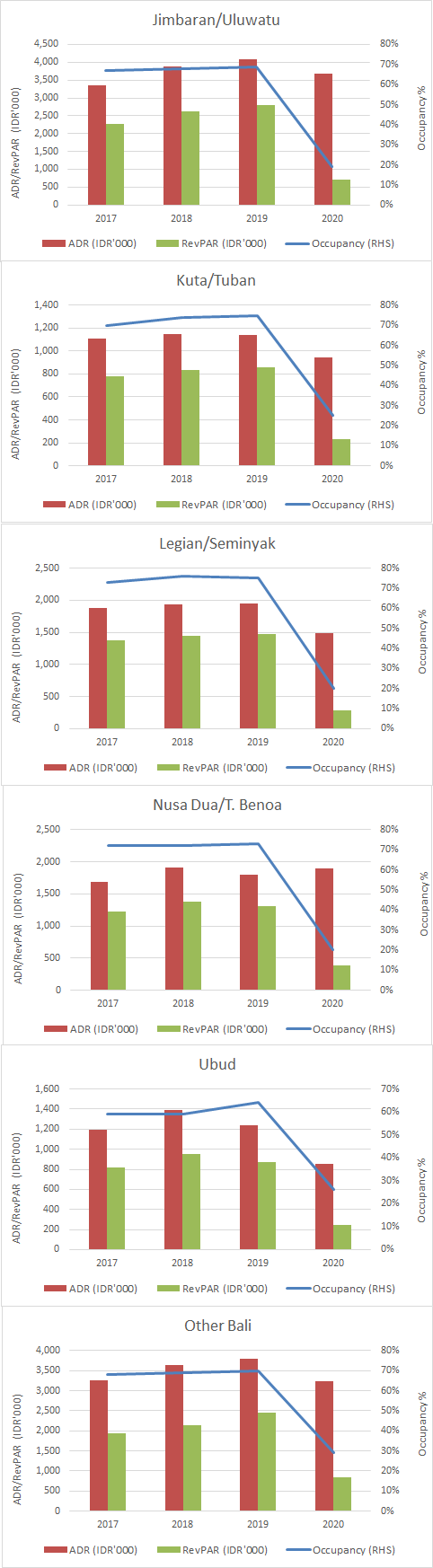

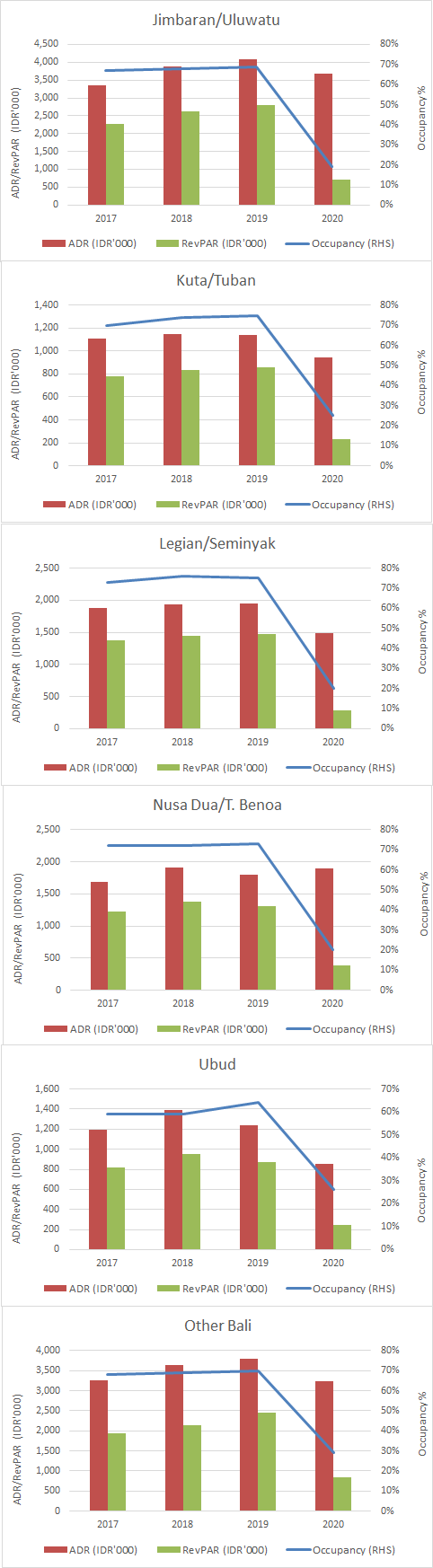

Even with a successful vaccination rollout, the successful creation of Green Zones in Bali, and the lifting of travel restrictions, the islands hotels, and resorts are not likely to return to “business as usual” for several years given the extent to which occupancy, ADR, and RevPAR have been impacted as illustrated in the graphs below. While RevPAR declined on average 73% in 2020 for Bali's star-rated hotels and resorts, Legian/Seminyak properties witnessed a decline of 80% according to the Bali Hotel Association and Horwath HTL.

Understanding how the hotel/resort sector may recover is key for hotel owners, operators, investors, and destination marketers. The depth and severity of the disruption have meant that forecasting practice “as usual” is no longer possible. From a statistical modeling and forecasting perspective, these disruptions cause unique challenges. The pandemic has meant that we cannot extrapolate the strong and persistent signals observed in Bali's historical tourism time series. We have therefore developed an innovative and robust forecasting methodology to help our clients.

As a first step, we use statistical models of historical data to generate COVID-free counterfactual forecasts assuming that the pandemic never occurred. As a second step, we use survey responses from experts to generate scenario-based probabilistic forecasts for pessimistic, most likely, and optimistic paths to recovery, enabling us to prepare upper and lower confidence limits. Using both sets of forecasts, we are able to provide estimates of the potential recovery trajectory for sub-markets and individual hotels throughout Bali.

The single most important benefit of this type of analysis is that it offers the opportunity to engage hotel owners, operators, and investors in a meaningful conversation about their risks. Put simply, the key output is the conversation, not the spreadsheet.

Source: Bali Hotel Association & Horwath HTL

The article wa written by Hotel Investment Strategies Founder and CEO, Ross Woods. To view more click here.

Similar to this:

Bali among the top provinces for hotel room sales and supply from 2014-2019